- EZ PRO TAXES LLC has been in operation since 2009. We have acquired several years of experience in Tax Preparation and Bookkeeping, providing services to Small Business Corporations, Sole Proprietorships, and Individuals...

Our offices are to your disposition for any kind of documentation you need.

Tax Preparation for Individuals and Small Businesses Corporations

We are registered and authorized agents for the Internal Revenue Service.

With several years of experience, we educate our clients to keep them informed on issues of tax. We offer Tax Preparation for Individuals and Small Businesses Corporations.

Help with Small Businesses

When starting a new business there are many important decisions to make and many rules and procedures to meet.

There is a place to go for everything you need, we are to solve them.

Preparation Forms W2 & 1099 for Employees

We take care of any Tax Forms, including Tax Form 1099 and Form W-2, to make your life easier, better and pleasant.

We handle everything.

Financial Consulting & Advice for Small Businesses

When you are determining the capital required to start your business, you have to project the costs in order to open the business (equipment, local, renewals, marketing, etc.) and plan business running costs (salaries, rent, utilities and others).

Many businesses are forced to close because these costs were not projected correctly.

All banks have different requirements and guidelines for giving loans, we advise you to see which is more compatible with their needs.

Bookkeeping for Self-Employed & Small Businesses

We take care of the tedious bookkeeping work, you get more time to focus on what you care about—helping your business succeed. Get an expert to organize, manage and maintain your books each month with guaranteed accuracy.

Trusted experts. Guaranteed accurate books. If you’re feeling disorganized and way behind on your financials, don’t sweat it.

We can get your overdue books caught up and organized for you—no matter how far behind you are.

Business Formation & Professional Guidance

Start Your Business with Confidence!

We help you launch your Sole Proprietorship, LLC, Partnership, S-Corp, C-Corp, or Non-Profit from start to finish. From checking your business name to registering with the State Corporation Commission, obtaining your EIN, and serving as your Registered Agent, we guide you every step of the way—plus expert advice on running your company right from day one.

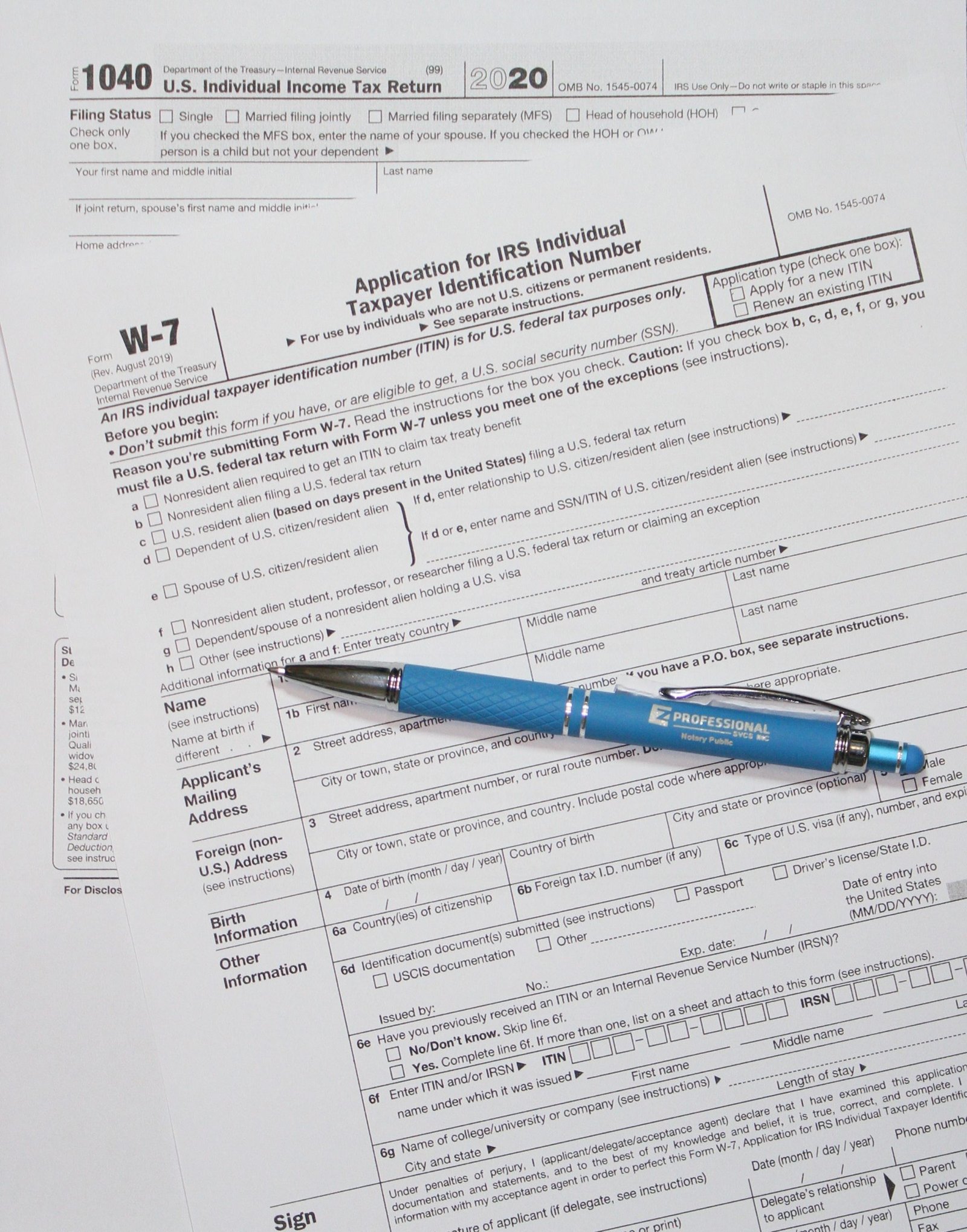

CERTIFIED

ACCEPTANCE

AGENT SERVICES

As an ITIN Certified Acceptance Agent, our certified staff has been authorized by the IRS to assist taxpayers in obtaining an ITIN.

We have the authorization from the IRS to review ITIN applications and issue ITIN numbers to qualified individuals with applicable purpose who are not eligible for a social security number in the US.

With us, you can keep your originals, bypassing the submission of original documents to the IRS for your applications.

The ITIN application process can be long and tedious and small mistakes can increase the length of the process or even get your application denied.

Our experienced Certified Acceptance Agents (CAAs) will walk you through the process and can assist with filling out the required W7 to make everything easy for you.

As Certified Acceptance Agents (CAAs), our services will bring you peace of mind.

-

What is an ITIN?

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service. The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number (SSN) from the Social Security Administration (SSA).

What is an ITIN used for?

IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers. They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. ITINs do not serve any purpose other than federal tax reporting.

An ITIN does not:

- Authorize work in the U.S.

- Provide eligibility for Social Security benefits

- Qualify a dependent for Earned Income Tax Credit Purposes

Do I need an ITIN?

Does the following apply to you?

- You do not have an SSN and are not eligible to obtain one, and

- You have a requirement to furnish a federal tax identification number or file a federal tax return, and

- You are in one of the following categories:

- Nonresident alien who is required to file a U.S. tax return

- U.S. resident alien who is (based on days present in the United States) filing a U.S. tax return

- Dependent or spouse of a U.S. citizen/resident alien

- Dependent or spouse of a nonresident alien visa holder

- Nonresident alien claiming a tax treaty benefit

- Nonresident alien student, professor or researcher filing a U.S. tax return or claiming an exception

If so, then you must apply for an ITIN.

Keep your small business compliant with the Corporate Transparency Act

File your beneficial Ownership Information Report with EZ Pro Taxes

Beginning January 1, 2024, your company may be required to report information about their beneficial owners – the persons who ultimately own or control the company – to the U.S. Department of Treasury’s Financial Crimes Enforcement Network, or FinCEN.

The Corporate Transparency Act (CTA) was enacted into Law in 2021 as part of the National Defense Authorization Act for Fiscal Year 2021. The CTA is intended to assist law enforcement in combating money laundering, tax fraud, financing of terrorism, and other illicit activity through anonymous shell and front companies. Beginning January 1, 2024, the CTA will require certain business entities to:

- Report certain Beneficial Ownership Information and Company Applicants to FinCEN

- Disclose information about who created the entity or registered it with the Secretary of State

- Report any changes to previously reported information within the specified time period

All businesses should determine their reporting responsibilities because failure to report required information can result in severe civil and criminal penalties, including fines up to $10,000- and two years’ imprisonment, as enforced by FinCEN.